WAN (Wide Area Network) optimization is an important part of enterprise network strategy for financial institutions. Community banks and credit unions utilize their WAN’s to transmit data to and from their branches and carry out daily functions regardless of location. The WAN is often comprised of public networks, such as the telephone system, leased lines, or satellites. Effectively managing your bank’s WAN consists of monitoring both the on-premise communication equipment (routers, layer 3 switches, firewalls, etc) and the circuits that carry the communication; however, this monitoring can be costly and complex. Let’s discuss some different options that today’s community financial institutions have to manage their WAN.

Option #1: WAN Management via the Carrier

Banks often use telecom carriers to provide network management for their WANs. Most telecom carriers offer an option that includes a router for termination of MPLS circuits, Internet access circuits, etc.

Banks use this option because it is the most economical approach to managing their WAN; however, expect minimal support. Carriers typically design simplified support tools to fight fires by focusing on managing the up/down status of the circuits. This reactionary type model offers minimum maintenance. The telecom carriers wait until they are notified of an issue, most frequently by the end user who, themselves, are only aware when they begin experiencing poor performance or downtime.

In most cases these tools simply aren’t sophisticated enough to allow for deep inspection of traffic patterns or usage. Even for administrators with enough expertise to keep WAN administration an internal function, these tools should be supplemented to allow for more proactive monitoring. Layering 3rd party software or services on top of the basic telecom-provided greatly enhances this approach to monitoring.

Pros: Least expensive option

Cons: Minimal support, supplemental 3rd party tools needed

Tip: Carrier-provided WAN management will focus primarily on WAN circuit status – they position themselves in this manner to limit their involvement concerning the overall functionality of your WAN. NOC’s (Network Operations Centers) are not profit centers within the carriers – most telecom NOC’s run “lean and mean.”

Option #2: WAN Management via Core Providers

Core providers also provide a network management option for your bank’s WAN. Most banks that use this strategy like the convenience of using a single provider for both core processing and WAN connectivity. All connections are seamlessly connected back to the core provider, and, depending on the vendor and purchased options, these connections may be more closely monitored by the core provider’s NOC. This option provides a single point of contact as well as a single bill for your bank’s solution.

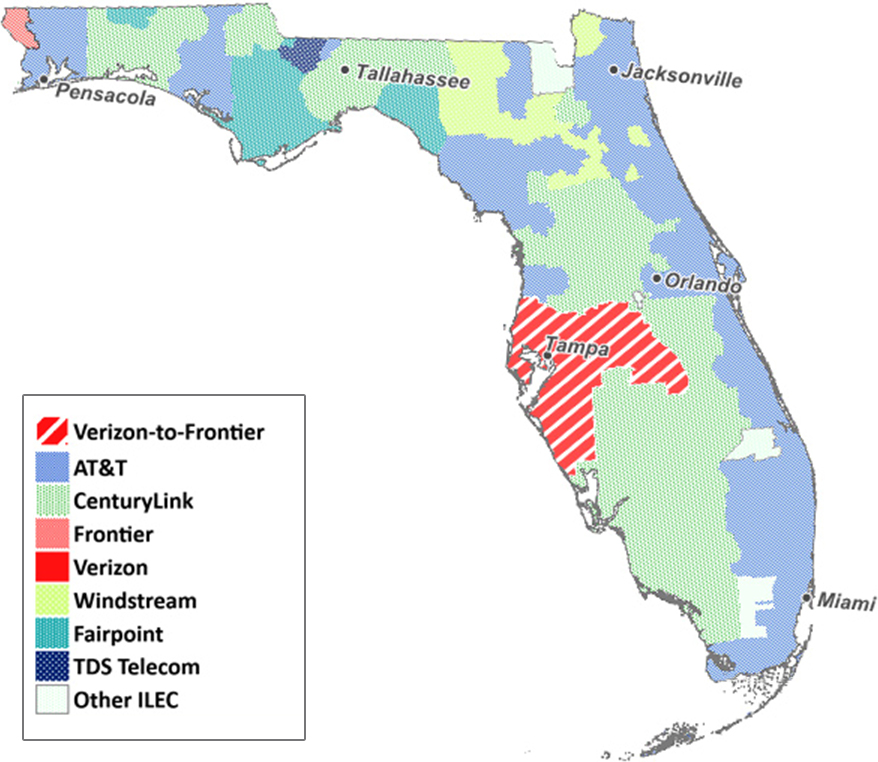

Expect to pay a premium for convenience. Core providers do not own the underlying infrastructure used to deliver the WAN circuits. Core providers typically use a single large national partner (e.g., AT&T, Verizon, etc.) to offer WAN connectivity services. Those underlying carriers have a profit margin to make, and that is stacked on top of the margin that core providers will take. Taken together, these factors make bundling through your core provider the most expensive way to manage your bank’s WAN.

Beyond the extra cost there is often another area that can prove to be problematic for your financial institution if you allow your core to provide your WAN. Core providers can be very limited in the flexibility of the WAN technology that they provide. Most bankers are familiar with the rigid standards required by core providers when you are running out of their service bureau. In much the same way, core providers tend to be very limiting on routing configurations. These restrictions are perhaps most visible to an average FI when they move to implement a BCP/DR strategy. Most cores will not allow the protocols required to have Internet and network server connectivity automatically re-routed in the event of an outage.

Pros: Single bill, single point of contact

Cons: Most expensive option, limited carrier choice, limited flexibility

Tip: Convenience offered by WAN management from core providers comes at a steep cost.

Option #3: WAN Management via a Managed Services Provider (MSP)

Many banks opt to use 3rd party MSP’s to manage their WAN connections. Many telecom carriers offer unmanaged circuits (i.e., they offer a circuit-only option that does not include a managed router). Under this approach, unmanaged loops are terminated on equipment that is bank-owned or provided by an MSP. The MSP manages the overall solution to varying degrees, based on the vendor and product.

Unlike the core providers, MSP’s typically have multiple arrangements with national carriers and will often offer more options for WAN connectivity. This flexibility typically translates into lower cost to the bank than their core provider can offer.

Another benefit offered by this approach is that you assign the proper roles and responsibilities to the appropriate parties. Carriers specialize in ensuring the simple up/down status of circuits and this management model allows them to focus on this one important responsibility. Similarly, MSP’s are responsible for the overall health and management of the WAN solution.

Pros: Best support, competitive pricing, multiple carrier options

Cons: Multiple bills, multiple contacts

Tip: MSP’s typically offer a wider variety of management tools and better reporting on WAN usage.

Engineering Best Practice/Conclusion

There are many choices when it comes to managing your bank’s network. While only management can decide which option is the best fit for your financial institution’s needs, a specialized MSP offers the most comprehensive set of services at a competitive price. While not the cheapest option available, a MSP may be the most cost-effective option by ensuring that your WAN properly fits your business needs. Such specialized 3rd party vendors can also offer the expertise necessary to help your bank explore more advanced networking, such as ensuring high availability and implementing disaster recovery fail-over scenarios for both core processor and Internet connectivity.

Don’t Go IT Alone!

It seems like IT budgets shrink every year, and IT staff members must often focus on other priority projects. The right vendor to help you seize control over your WAN should offer an experienced staff that can guide you through the process of designing a WAN infrastructure. Don’t accept a one-size-fits-all solution, and seek out a vendor that will listen to your concerns in order to help implement a management strategy that meets your requirements. WAN connectivity presents a significant recurring business expense, and a solid WAN management partner can help you get the most out of this investment.

Dispelling 5 IT Outsourcing Myths within Financial Institutions

Learn why five of the most commonly believed “facts” about IT outsourcing within community financial institutions are actually myths.

Many financial institutions are turning to IT and security service providers to act as an extension of their organization and help augment internal technology and compliance resources. The right third-party solution provider can serve as a true partner and work alongside current staff to manage the technology, compliance and regulatory aspects of the institution. When the technology or compliance staff is out or unavailable, outsourcing select business processes helps fill the personnel gap and provide added stability for the institution and peace of mind to all.

Many financial institutions are turning to IT and security service providers to act as an extension of their organization and help augment internal technology and compliance resources. The right third-party solution provider can serve as a true partner and work alongside current staff to manage the technology, compliance and regulatory aspects of the institution. When the technology or compliance staff is out or unavailable, outsourcing select business processes helps fill the personnel gap and provide added stability for the institution and peace of mind to all.

One challenge financial institutions face is that running and maintaining server hardening services strains the resources of a limited IT staff. Banks and credit unions are already swamped with ensuring their servers are secure, which includes examining vulnerability assessment reports, fixing numerous findings, troubleshooting services, and addressing patch management, antivirus, and other activities on an ongoing basis.

One challenge financial institutions face is that running and maintaining server hardening services strains the resources of a limited IT staff. Banks and credit unions are already swamped with ensuring their servers are secure, which includes examining vulnerability assessment reports, fixing numerous findings, troubleshooting services, and addressing patch management, antivirus, and other activities on an ongoing basis.

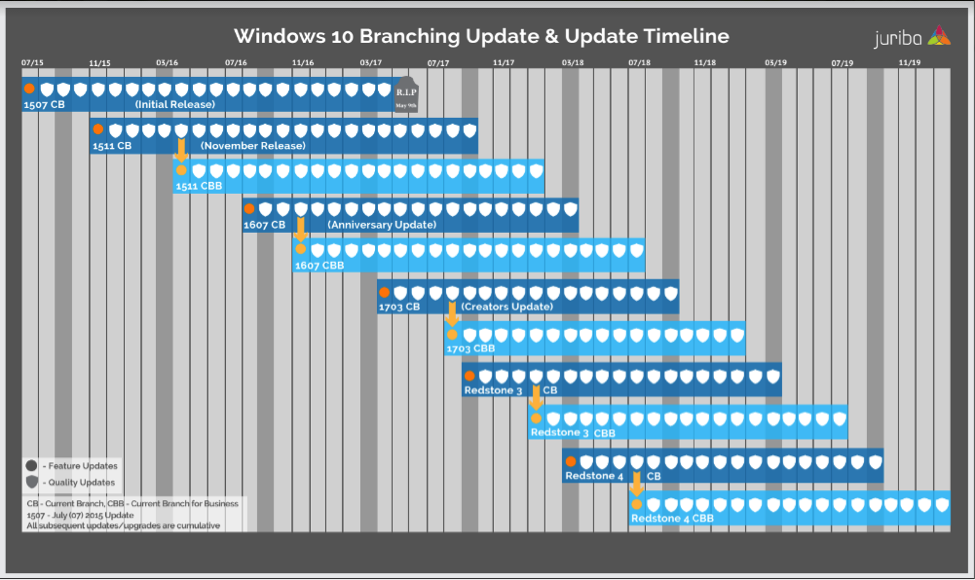

Knowing key dates in a product’s lifecycle helps organizations make informed decisions about when to upgrade or make other changes to software. Microsoft ended support in May 2017 for build number 1507, which means it no longer provides automatic fixes, updates, or online technical assistance for this version. Without Microsoft support, financial institutions will no longer receive important security updates that can help protect PCs from harmful viruses, spyware, and other malicious software that can steal information and infect networks. Because of this, we recommend systems be upgraded before they reach their end of life whenever possible.

Knowing key dates in a product’s lifecycle helps organizations make informed decisions about when to upgrade or make other changes to software. Microsoft ended support in May 2017 for build number 1507, which means it no longer provides automatic fixes, updates, or online technical assistance for this version. Without Microsoft support, financial institutions will no longer receive important security updates that can help protect PCs from harmful viruses, spyware, and other malicious software that can steal information and infect networks. Because of this, we recommend systems be upgraded before they reach their end of life whenever possible.

Oconee State Bank had already successfully implemented a previous version of Safe Systems’

Oconee State Bank had already successfully implemented a previous version of Safe Systems’

Safe Systems currently monitors more than 20,000 devices and roughly 80% of all issues addressed come through our monitoring systems. Just by implementing Safe Systems NetComply One with SSAI, the number of alerts sent to an IT support team is decreased by an average of 89%. By effectively correcting known problems and only notifying your team about more significant issues, SSAI creates tremendous value for your institution, your employees and your infrastructure.

Safe Systems currently monitors more than 20,000 devices and roughly 80% of all issues addressed come through our monitoring systems. Just by implementing Safe Systems NetComply One with SSAI, the number of alerts sent to an IT support team is decreased by an average of 89%. By effectively correcting known problems and only notifying your team about more significant issues, SSAI creates tremendous value for your institution, your employees and your infrastructure.

In today’s banking environment, community banks recognize and embrace the use of technology and remain committed to investing in new technologies and services moving forward. In fact, nearly 77% of respondents claim they are spending more on technology today than they have in the past. However, the challenge often lies in trying to keep pace with the rapid rate of change that is influencing their business. Community banks are continuing to explore ways to enhance and augment their IT departments, as many institutions struggle to maintain adequate personnel needed to manage the complex activities required of the IT department. To counter this, 71% of respondents have turned to outsourcing their network management and 63% have outsourced their IT support.

In today’s banking environment, community banks recognize and embrace the use of technology and remain committed to investing in new technologies and services moving forward. In fact, nearly 77% of respondents claim they are spending more on technology today than they have in the past. However, the challenge often lies in trying to keep pace with the rapid rate of change that is influencing their business. Community banks are continuing to explore ways to enhance and augment their IT departments, as many institutions struggle to maintain adequate personnel needed to manage the complex activities required of the IT department. To counter this, 71% of respondents have turned to outsourcing their network management and 63% have outsourced their IT support.

Banks should make continual service improvement a key part of their overall corporate culture. These changes can be identified by a single resource or through a committee focusing on operational improvement. Allocating time and resources to focus on the right aspects of new technology and process improvement is key as even the smallest incremental changes can have the ability to provide a significant positive impact.

Banks should make continual service improvement a key part of their overall corporate culture. These changes can be identified by a single resource or through a committee focusing on operational improvement. Allocating time and resources to focus on the right aspects of new technology and process improvement is key as even the smallest incremental changes can have the ability to provide a significant positive impact.

![Computer-Tree---illustration-[Branded]](http://www.safesystems.com/wp-content/uploads/2015/11/Computer-Tree-illustration-Branded.png)