It’s summertime. And COVID restrictions are finally being lifted. Maybe now your IT administrator can go on vacation—if there’s someone available to fill in.

Third-party IT and security service providers can make it easier for smaller banks and credit unions to manage when staff takes time off. Here are five areas where financial institutions can outsource to maintain adequate IT resources—and peace of mind—while the IT administrator is out of the office enjoying some downtime:

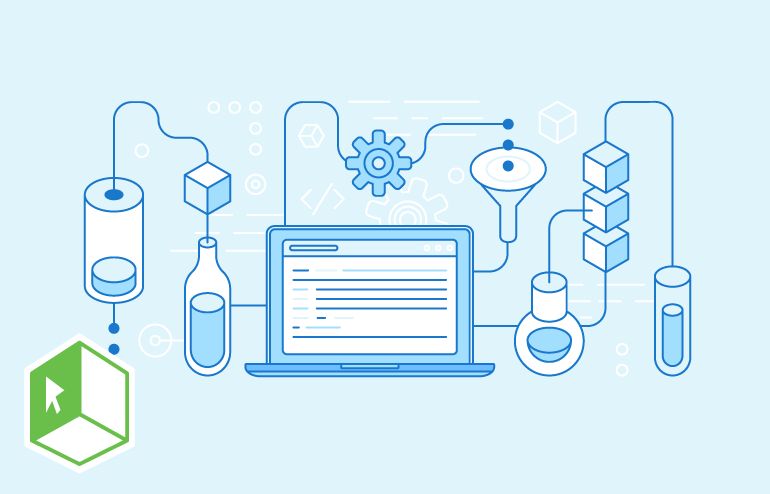

1. Network monitoring for diagnostic or security issues — Monitoring is critical for detecting, diagnosing, and resolving network performance issues. A network monitoring solution can gather real-time information to ensure the system is being effectively managed, controlled, and secured. With proactive monitoring, IT staff can find and fix network issues more quickly and easily. This can help them keep the network operating smoothly, stay ahead of outages, and avoid expensive downtime. It can also help the IT department maintain critical business services and reduce potential security risks for the institution. Outsourcing network monitoring can lighten the workload for time-strapped staff who are probably juggling more tasks while the IT administrator is away.

2. Managed replication and real-time backup to the cloud — Replication tools can automate the process of copying data across multiple sources, relieving the IT department from the burden of monitoring backups on a daily basis. The data gets stored in multiple locations, increasing its redundancy and resiliency. Using cloud-based managed data replication and backup solutions can make it easier for institutions to have the data they need to maintain normal business functions. It also provides another major benefit: No matter where the network admin is, it will be easy to restore data if a hardware failure, power outage, cyberattack, or some other disaster impacts the system.

3. Regulatory and IT reporting — The need for data to confirm controls are in place does not go away when someone leaves or goes on vacation. It is important for management to have access to timely reporting about IT issues to enhance security and meet regulatory compliance. Having a system in place that generates reports in a single location, rather than manually created reports or reports pulled from disparate systems helps ensure data on security controls can be reviewed by anyone anytime. Partnering with a third-party provider that can aggregate reporting and control data can make it easier for institutions to meet these requirements.

4. IT support experts — Financial institutions must have the appropriate IT expertise to stay on top of complex security issues. Outside vendors can provide access to IT specialists who can augment the efforts of their IT team. The added support not only can be a godsend while the system administrator is on vacation, but it can also meet an ongoing need. An institution can use outside experts to provide technical knowledge and resources that may be lacking in the IT department.

5. Cloud-based infrastructure — Virtual servers, storage, software, and other cloud-based solutions offer access to resources on demand. And since cloud infrastructure is flexible and scalable, it is the ideal way to modernize a computer system and build redundancy. Using cloud-based infrastructure allows financial institutions to have duplicate copies of their data and core systems available whenever they’re needed. So, if an IT issue comes up, a third-party service provider can troubleshoot the problem remotely while the IT administrator is on leave.

Safe Systems offers a range of IT and security solutions to help institutions keep their operation and network running efficiently. Learn more about how our compliant solutions can provide professional support whenever your IT administrator takes a much-needed break.

The bank sought a trusted technology partner that clearly understood IT and compliance processes for financial institutions and had the expertise to monitor and manage the network efficiently. The bank’s new CEO had previous experience working with Safe Systems while at another bank and recommended they contact the outsourced IT provider. The bank chose to partner with Safe Systems and utilize its NetComply® One IT network management solution.

The bank sought a trusted technology partner that clearly understood IT and compliance processes for financial institutions and had the expertise to monitor and manage the network efficiently. The bank’s new CEO had previous experience working with Safe Systems while at another bank and recommended they contact the outsourced IT provider. The bank chose to partner with Safe Systems and utilize its NetComply® One IT network management solution.

While it is true that outsourcing can be expensive, the benefits have proven to consistently

While it is true that outsourcing can be expensive, the benefits have proven to consistently  It is simply no longer necessary for IT partners to be onsite to

It is simply no longer necessary for IT partners to be onsite to  Regardless of location and size, small community banks and credit unions are under most of the same regulations as larger institutions, forcing a small IT staff to be well-versed in all regulatory guidance from cybersecurity to disaster recovery to meet examiner expectations. Auditors and examiners expect thorough documentation to prove that the institution’s daily practices match its defined policies and procedures. Financial institutions should not wait for a negative review finding to take a proactive approach to network management. Working with service providers that have dedicated staff and experts who understand the financial industry’s regulatory requirements and best practices ensures the required planning and reporting is completed in a timely manner.

Regardless of location and size, small community banks and credit unions are under most of the same regulations as larger institutions, forcing a small IT staff to be well-versed in all regulatory guidance from cybersecurity to disaster recovery to meet examiner expectations. Auditors and examiners expect thorough documentation to prove that the institution’s daily practices match its defined policies and procedures. Financial institutions should not wait for a negative review finding to take a proactive approach to network management. Working with service providers that have dedicated staff and experts who understand the financial industry’s regulatory requirements and best practices ensures the required planning and reporting is completed in a timely manner.  There are hundreds of tasks that a small IT staff must complete on a regular basis to keep the bank’s operations running efficiently. Many community financial institutions have limited in-house resources dedicated to IT network functions. If a critical staff member goes on a

There are hundreds of tasks that a small IT staff must complete on a regular basis to keep the bank’s operations running efficiently. Many community financial institutions have limited in-house resources dedicated to IT network functions. If a critical staff member goes on a  Without a doubt, the core banking platform is central to all financial institutions. However, you may be taking unnecessary risk by relying on them for all your needs. An IT services provider can help alleviate the stress by evaluating the infrastructure of the bank without bias, and eliminating the unnecessary hardware, processes and tasks, helping with overall management and ongoing cost. Whether it be network management, security, or compliance, it is unlikely your core will match the expertise a specialized partner can offer. Network management providers offer unbiased advice, while also diversifying your risk.

Without a doubt, the core banking platform is central to all financial institutions. However, you may be taking unnecessary risk by relying on them for all your needs. An IT services provider can help alleviate the stress by evaluating the infrastructure of the bank without bias, and eliminating the unnecessary hardware, processes and tasks, helping with overall management and ongoing cost. Whether it be network management, security, or compliance, it is unlikely your core will match the expertise a specialized partner can offer. Network management providers offer unbiased advice, while also diversifying your risk. Many financial institutions struggle with choosing the right solutions partner. Smaller institutions in particular can benefit from outsourcing or partnering with a provider who offers network management solutions exclusively tailored for community banks and credit unions. Having a system in place that offers key features such as patch management, third party patching, antivirus, hardware and software inventory management, vulnerability remediation, and compliance-focused reporting to verify that your financial institution’s network is adhering to your policies and procedures is critical in today’s environment.

Many financial institutions struggle with choosing the right solutions partner. Smaller institutions in particular can benefit from outsourcing or partnering with a provider who offers network management solutions exclusively tailored for community banks and credit unions. Having a system in place that offers key features such as patch management, third party patching, antivirus, hardware and software inventory management, vulnerability remediation, and compliance-focused reporting to verify that your financial institution’s network is adhering to your policies and procedures is critical in today’s environment.

One challenge financial institutions face is that running and maintaining server hardening services strains the resources of a limited IT staff. Banks and credit unions are already swamped with ensuring their servers are secure, which includes examining vulnerability assessment reports, fixing numerous findings, troubleshooting services, and addressing patch management, antivirus, and other activities on an ongoing basis.

One challenge financial institutions face is that running and maintaining server hardening services strains the resources of a limited IT staff. Banks and credit unions are already swamped with ensuring their servers are secure, which includes examining vulnerability assessment reports, fixing numerous findings, troubleshooting services, and addressing patch management, antivirus, and other activities on an ongoing basis.

Oconee State Bank had already successfully implemented a previous version of Safe Systems’

Oconee State Bank had already successfully implemented a previous version of Safe Systems’

Safe Systems currently monitors more than 20,000 devices and roughly 80% of all issues addressed come through our monitoring systems. Just by implementing Safe Systems NetComply One with SSAI, the number of alerts sent to an IT support team is decreased by an average of 89%. By effectively correcting known problems and only notifying your team about more significant issues, SSAI creates tremendous value for your institution, your employees and your infrastructure.

Safe Systems currently monitors more than 20,000 devices and roughly 80% of all issues addressed come through our monitoring systems. Just by implementing Safe Systems NetComply One with SSAI, the number of alerts sent to an IT support team is decreased by an average of 89%. By effectively correcting known problems and only notifying your team about more significant issues, SSAI creates tremendous value for your institution, your employees and your infrastructure.