Banks and credit unions require a complex interconnected infrastructure to support their employees, serve customers, and maintain their operations. This entails an array of owned and outsourced elements: hardware, software, controls, processes, and evolving technologies such as cloud, artificial intelligence (AI), machine learning, and more. In addition, effective data governance and data management are fundamental to maintaining the confidentiality, integrity, and availability of information. The data management process is highly regulated and financial institutions are under increasing pressure when trying to balance the strategic needs of their organization with the increased demands for remote employees and online customers.

Evolving Remote Workforce and Customer Base

Over the past couple of decades, advancements in communication and technologies have allowed for a more mobile workforce and customer base, and the ongoing COVID-19 pandemic quickly intensified this trend. During the first year of the pandemic, Gartner conducted a survey that found 82% of businesses intended to allow remote work at least part of the time, with 47% of companies allowing it full time. Although 2o20 represented a significant increase in remote work and digital engagement, the trend seems to be continuing for the foreseeable future. According to Upwork’s Future Workforce Report 2021, 40.7 million American professionals, nearly 28% of respondents, will be fully remote in the next five years, up from 22.9% from the last survey conducted in November 2020.

This trend requires adding more technology and devices to enable online access to financial services, and to enable secure access to the information and other resources needed for remote workers to perform their duties away from the office. Banking customers want convenient access to financial services, whether through a physical location, the internet, or a mobile app, and institutions need the tools and techniques to keep them secure. With more devices in the hands of employees and customers, there are many more vectors for cyberattacks and way more endpoints to secure. Even institutions that have been trying to avoid the risks that come with enabling remote engagement are forced to reevaluate the costs and benefits.

Increasing Regulatory Requirements

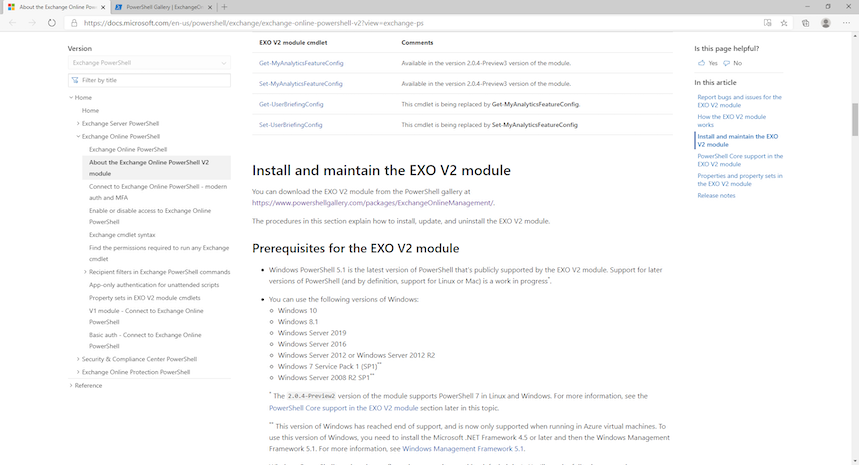

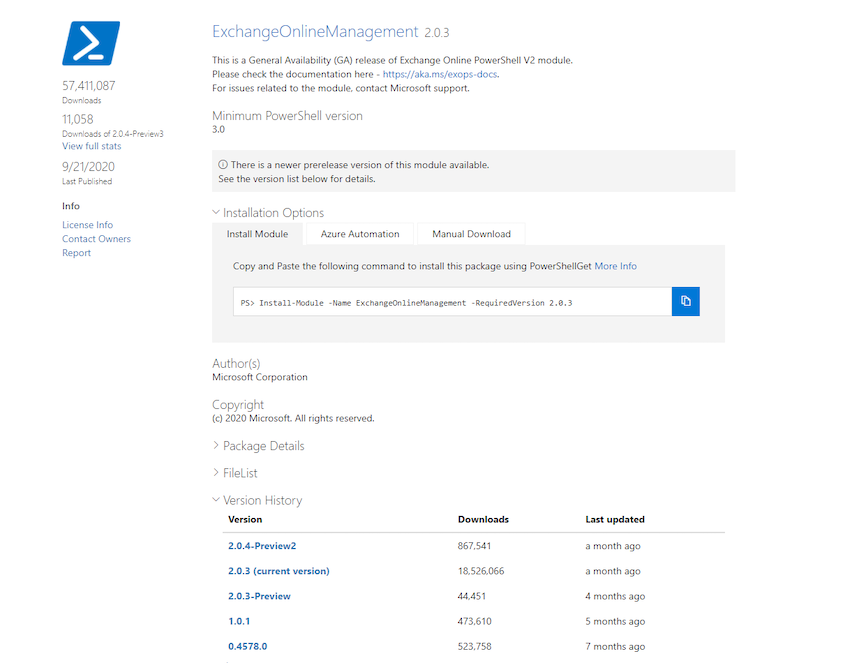

Privacy and data security have become key compliance issues for financial institutions as they adapt to accommodate employees and customers who prefer to work and bank remotely. From a regulatory standpoint, the Federal Financial Institution Examination Council (FFIEC) has always expected financial institutions to have data management controls in place to protect data in physical and digital forms wherever the data is stored, processed, or transmitted. This includes any data relating to the organization, its employees, and its customers. “The data management process involves the development and execution of policies, standards, and procedures to acquire, validate, store, protect, and process data,” states the FFIEC IT Handbook’s Architecture, Infrastructure, and Operations booklet. “Effective data management ensures that the required data are accessible, reliable, and timely to meet user needs.”

The FFIEC requires institutions to follow a wide range of other guidelines and procedures, which are reflected in various FFIEC booklets and include:

- Governance – Management should promote effective IT governance by establishing an information security culture that promotes an effective information security program and the role of all employees in protecting the institution’s information and systems.

- Know-your-customer – Financial institution management should choose the level of e-banking services provided to various customer segments based on customer needs and the institution’s risk assessment considerations.

- Resilience – Financial institutions are responsible for business continuity management (BCM), which is the process for management to oversee and implement resilience, continuity, and response capabilities to safeguard employees, customers, and products and services.

Strategic Compliance Solutions

With so many compliance issues to address, it can be difficult to balance the needs of your financial institution, your remote workers, and your customers. Safe Systems has a team of compliance experts and a broad range of compliance solutions to help you manage government regulations, information security, and reporting efficiently. Our team of compliance experts are trained in banking regulations, hold numerous certifications, and are laser-focused on delivering the tools and knowledge to give you compliance peace of mind.