The “Inherited” Risk – Assessing and Reporting on Vendor Risk

Vendors are the largest source of non-preventable risk for a financial institution, so it is critical that banks and credit unions carefully evaluate, monitor, and manage all vendor relationships to remain compliant and reduce risk. Additionally, institutions must be able to accurately assess risk, implement adequate controls, and provide all stakeholders (including regulators, management, and the Board) with appropriate reporting to convey the overall status of the vendor management program at any point in time.

Assessing Vendor Risk

The first step in vendor risk management is to perform a risk assessment to evaluate your level of inherent risk. This must always be done first so that you can then identify and implement the proper controls. If the controls selected do not completely offset the risks identified, then alternate or compensating controls would need to be identified in order to achieve a level of residual risk that is within your risk appetite.

Depending on the information you get from the risk assessment, you can clearly map out the level of inherent risk based on the vendor’s access to data and systems and the level of criticality for each vendor. These results will provide the information you need to control the risks, and ultimately report the overall results of your vendor management program to your key stakeholders.

When conducting a risk assessment you want to include all vendors but focus particularly on your critical vendors. A critical vendor is defined as one that either provides a product or service that is a key interdependency of one or more of your products or services, or one that stores, processes, or transmits non-public customer or confidential information.

Once you’ve established the initial or inherent risk level, you can identify one or more controls to off-set the risks. Typically, you want the vendor’s third-party audit report or SOC report; audited financials; insurance binders; a copy of their incident response and disaster recovery plans; and any testing the vendor has done on these plans. If you can’t obtain a SOC report, you’ll need compensating controls to determine their network security. Ask if they have an information security program and if they’ve conducted any vulnerability and penetration testing. You should also request a report of examination (ROE) from your primary federal regulator on your core provider.

Reporting to Stakeholders

When reporting to the various stakeholders within your institution, many of the reports are relatively similar, but the level of detail will be slightly different for each stakeholder group.

Board

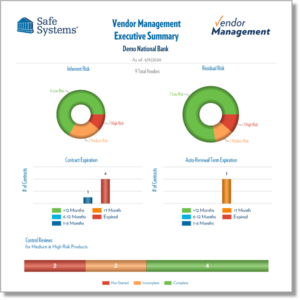

The primary stakeholder that financial institutions must report to is the Board. When presenting to the Board, reporting does not generally need to be highly detailed and should provide a brief, high-level summary of the overall program.

Additionally, it is not necessary for the Board to see this report every time they meet. The requirement is to present an annual update, but we recommend reporting more often if the pace of internal change dictates (whether twice a year or quarterly) to show you are adequately managing vendor risk on an on-going basis. Here is an example of what a Board report should look like:

Management

The management committee (i.e. IT Steering) requires a bit more detailed information than the Board does, and unlike Board reporting frequency, IT should report to the management committee every time they meet. If your management committee meets on a monthly basis, you should produce a report each month as well and communicate this information to the committee. Management needs to know what you’re doing; what you’re not doing; what you’re behind on; and have a good understanding of your progress.

Regulators

Regulators typically review the same reports as your board and committee. However, auditors and examiners will tend to take a deeper dive into your vendor management program and want to review everything you have on your critical vendors. They are looking to see if you’ve done a risk assessment and if you have identified the reports from the vendor that will line up with, control, and offset the risks you identified in the risk assessment. The report you present to examiners and auditors may have more of a narrow but deeper focus, taking a more detailed view of your most critical vendors.