According to the Federal Financial Institution Examination Council’s (FFIEC) Information Technology Examination Handbook, “ISOs are responsible for responding to security events by coordinating actions to protect the institution and its customers from imminent loss of information, managing the negative effects on the confidentiality, integrity, availability, or value of information, and minimizing the disruption or degradation of critical services.”

When faced with an operational crisis such as the current Covid-19 Pandemic, potential disruption of critical services is the primary concern. Since the information security officer (ISO) acts as the “quarterback” over the many different departments and functions within the institution, they must make sure all routine tasks are still being completed, in addition to ensuring that the institution has adapted to the unique circumstances of the crisis.

The FFIEC Management Handbook lists 8 broad categories of responsibilities for ISO’s. We’ve identified a few of those areas that should be of particular focus during a crisis:

Working With The IT Steering Committee

During any crisis, the ISO must work closely with the IT Steering Committee to ensure that the institution minimizes the risks to the security and confidentiality of non-public information and financial transactions. As difficult as this is during normal operations, it may be even more of a challenge during a crisis. Key considerations include:

- The IT Steering Committee should still perform their normal duties and maintain a normal schedule. Phone /video conferences can suffice if in-person meetings are not an option.

- Attention to on-going and planned IT project road map/initiatives. Timelines and all supporting activities must still be tracked, project plans updated, and all stakeholders informed.

- Review the Remote Access Policy and the Remote User / Acceptable Use Acknowledgement with IT and HR as your current situation may include unique risks that have not been previously addressed. For example, some employees may have to use their personal devices to access the FI’s network to do their job. Take particular note of the Remote Access and Use of Remote Devices sections of the FFIEC Information Security Handbook and any other related best practices and/or guidance initiatives. Trusted third parties can also be an important resource for this effort.

- Document all actions taken and lessons learned during the crisis so far. Then, incorporate them into your next round of policy updates.

- Continue to report the status of all IT and information security activities to the Board.

Managing Incident Response, BCP/IRP, and Cyber Responsibilities during an Adverse Event

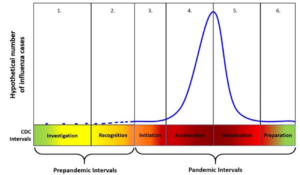

The ISO is typically the Incident Response Team Coordinator and may determine whether or not to activate the formal Incident Response Plan (IRP). The declaration of a pandemic or other adverse operational event does not in itself require the IRP to be invoked, however, any disruption of normal business services may create vulnerabilities that a cyber attacker could take advantage of.

The ISO will also likely be involved with general business continuity planning and recovery efforts. The criteria for activating the Business Continuity Plan will vary by institution, but the ISO is typically one of the few key individuals tasked with evaluating whether the event is likely to negatively impact the institution’s ability to provide business products and services to customers beyond recovery time objectives (RTOs).

In adverse situations, cyber awareness should be heightened. For example:

- The institution could have key personnel out, and alternate personnel may not be adequately trained or have the same level of cyber awareness as the primary staff members.

- The institution may be implementing workarounds for new software or devices when trying to accommodate customers affected by the event. In the interest of expediency for customers, the institution may take shortcuts that it normally wouldn’t or otherwise fail to follow normal procedures.

- The institution could run into issues with the critical vendors that perform or support its perimeter security, compromising real-time alerting for the organization. This is known as “cascading impact”, where a product or service provided by a third-party is degraded, which in turn affects you.

- The institution could experience secondary disruptions where hackers may attempt a cyber-attack against perceived weakened defenses.

The ISO must anticipate all of these risks and should communicate with critical third parties to ensure they have a plan in place to keep the NPI and financial transactions secure and provide critical operational services at acceptable levels of risk.

Addressing Auditor and Examiner Expectations

Although a pandemic, as a crisis event, was de-emphasized in the 2019 BCM Handbook, financial institutions should expect regulators to issue additional joint statements in the post-pandemic phase due to the shear impact and duration of this event. ISOs should expect examiners to ask about the specific actions the institution has taken in response to COVID-19, including:

- Succession plans – ISOs should be prepared to share the institution’s succession plans, how these plans were implemented during the pandemic, and any key updates to the plan post-pandemic.

- Cross-training efforts – the ISO (if also the BCP Coordinator) should explain the institution’s plans for cross-training and how these plans were implemented during the pandemic.

- Remote access controls – the ISO should address all of FFIEC requirements for remote access and document any updates or changes that occur.

- Third-party/supply chain issues – the ISO should communicate with all critical vendors to ensure there are no interruptions to critical services, and he or she should have contingency plans in place if a third-party provider can no longer provide adequate service.

Information security officers ultimately must be able to show auditors and examiners exactly how the institution withstood the pandemic, maintained compliance, kept all non-public information secure, and kept all stakeholders informed, all of which is no small task during normal operations!

For more information on responding to crisis events, view our pandemic resources.