Building a Pandemic Response Plan: What Are the Requirements for Community Banks and Credit Unions?

As COVID-19 continues to spread around the world, financial institutions have been forced to respond to this pandemic in new and innovative ways to stop the spread of the virus; protect their employees and the public; and keep their doors open and operations running smoothly to serve their customers and members. Community banks and credit unions are referencing the Pandemic sections of their business continuity management plans to determine the best way forward for their institutions during this challenging time. With the Federal Financial Institution Examination Council’s (FFIEC) recent business continuity management (BCM) guidance, many financial institutions are first of all wondering what has changed in the guidance, and second what specific additional changes this particular event might require.

Pandemic Planning

Since 2007, financial institutions were required to have a separate pandemic plan, and regulators only looked for documentation that institutions were testing their plans periodically. Unfortunately, the pandemic section of the business continuity plan (BCP) has tended to be treated as more of an afterthought since these situations have historically occurred much less often than natural disasters or other business interruptions. If they were assessed at all, they fell into the category of a high impact, low probability event.

Notwithstanding COVID-19, pandemics are still low probability events, but the impact of these events may be far more significant than past risk assessments have indicated. In what may now be perceived as an untimely move, the FFIEC made the decision in the 2019 BCM update to deemphasize Pandemic by categorizing it the same as any other disruptive event. The FFIEC no longer requires financial institutions to have a separate pandemic plan, but instead expects community banks and credit unions to assess and manage pandemic risk alongside all other possible disasters.

In other words, your BCM plan is your pandemic plan, and you must analyze the impact a pandemic can have on your organization; determine recovery time objectives (RTOs); and build out a recovery plan. You must also include a methodology to determine the key triggers your organization will use to activate your recovery plan when faced with a pandemic. But when should you activate your recovery plan and who is in charge of this process?

Pandemic Response

Before a recovery plan is activated, it is important to have an initial response team (typically comprised of C-Level executives) evaluate the situation and assess the potential impact of the current event on the institution. The team must determine if the situation is likely to negatively impact the institution’s ability to provide products and services to their customers or members beyond the established recovery time objectives outlined in the BCM plan.

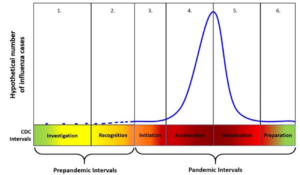

The same rules apply in a pandemic. Community financial institutions should use the six pandemic phases outlined by the World Health Organization (WHO) or the Center for Disease Control (CDC) to evaluate the severity of the situation.

In most cases, the pandemic portion of the plan is not triggered for activation until phases 4-5 (or if between 20-40% of your workforce is not available to work).

What Regulators Expect

During a pandemic, regulators expect financial institutions to continue offering products and services to customers/members and conduct operations as normally as possible. This underscores the importance of including succession planning and cross training in the BCM plan. In the past, assumptions used to simulate a pandemic were that phases 4-5 wouldn’t last more than a week or two, so most financial institutions may only have planned for one person to be identified and pre-trained to step into a critical role until the event was over. However, the COVID-19 pandemic is a global crisis currently impacting at least 183 countries and territories and is predicted to impact many more people, and take much more time to contain.

To ensure critical functions continue, financial institutions should have at least two or three alternate staff members trained for every primary resource within the institution and assess whether some roles can be performed remotely. This can be difficult for smaller institutions with limited staff and resources. For specialized functions dominated by key personnel, such as funds management, wire services, human resources, etc., these institutions may not have multiple alternatives to step in if key employees are unavailable. In these circumstances, you may need to have other cross-trained staff members identified who can step into these roles quickly.

Next Steps: Lessons Learned

There will be many more lessons learned after the COVID-19 pandemic has passed, and regulators will expect those lessons to be reflected in your plan. When all is said and done, regulators are likely to ask “what have you learned from this event, and what have you done to enhance your pandemic plan based on those lessons learned?” Prior to this event, had you analyzed your business processes and their interdependencies, and prioritized them by recovery time? Since interdependencies include employees, and pandemic events almost exclusively impact personnel, have you identified employees with job duties capable of being performed remotely? If so, did they have secure, reliable, remote access? If those job duties are highly specialized, or highly critical, did you have alternate personnel identified and pre-trained to step in when needed?

The answers to these questions, and many more, will be used to enhance the pandemic section of your BCM plans, but until we reach that post-event, lessons-learned point, it’s important for financial institutions to continue to reference their business continuity plans; document the entire process; keep stakeholders informed; and put measures in place to continue serving their customers and members and protecting their employees and the public.

For more information on pandemic response, view our pandemic resource center. Or, if you would like to make sure your BCM is up to date, please request a complimentary plan review to ensure that your business continuity management plan is keeping up with changing regulations.