With a new year approaching, it’s a good time to review some of the key discussions from the past year. Read these highlights from our top blog posts of 2021, to help your financial institution refine key operational strategies for 2022 and beyond:

1. 2021 Hot Topics in Compliance: Mid-Year Update

Although the COVID-19 pandemic isn’t over, financial institutions have learned valuable lessons so far. Key impacts have been primarily operational, involving risks related to temporary measures taken to weather the crisis. In addition, there are important compliance trends and new regulatory guidance institutions should anticipate going forward. Ransomware cybersecurity has been a key area of focus for regulators, and given the recent high-profile cyber events affecting the industry, their scrutiny will likely increase in the future. This will be reflected, in part, by the number of (and types of) assessments that regulators might expect institutions to perform annually. These assessments from various state and federal entities include the Cybersecurity Assessment Tool (CAT), the optional Ransomware Self-Assessment Tool (R-SAT), the Cybersecurity Evaluation Tool, and the modified Information Technology Risk Examination for Credit Unions (InTREx-CU). In addition, there have been major shifts with cyber insurance, and the FFIEC released a new Architecture, Infrastructure, and Operations booklet in its Information Technology Examination Handbook series. Read more.

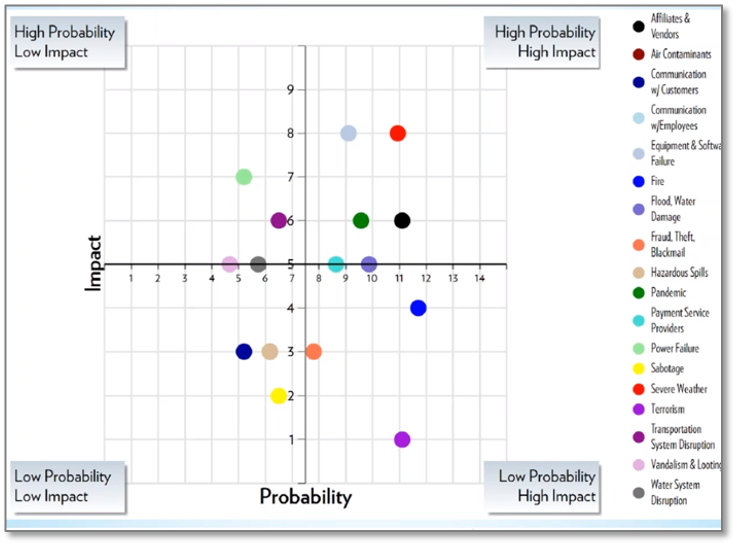

2. The 4 “R’s” of Disaster Recovery

Maintaining an effective approach to disaster recovery can help financial institutions satisfy regulatory requirements, better protect themselves from the effects of negative events, and improve their ability to continue operating after a disaster. There are four important “R’s” that institutions should concentrate on for disaster recovery: recovery time objective ( RTO ), recovery point objective ( RPO ), replication , and recurring testing .

RTO is the longest acceptable length of time a computer, system, network, or application can be down after a disaster happens. When establishing RTOs, prioritizations must be made based on the significance of the business function and budgetary constraints. The RPO is the amount of time between a disaster occurring and a financial institution’s most recent backup. Essentially, the RPO will be determined by the institution’s technology solution and risk tolerance. DR replication entails having an exact copy of an institution’s data available and remotely accessible when an adverse event transpires. The best practice is to keep one backup copy onsite and another offsite in a different geographic location that’s not impacted by the disaster. Recurring testing allows institutions to identify key aspects of their DR strategy and adjust as needed to accomplish their objectives. Regular testing can expose potential problems in their DR plan so they can address these issues immediately. Read more.

3. Segregation of ISO Duties Critical to Network Security and Regulatory Compliance for FIs

It’s crucial for financial institutions to maintain distinct duties between their information security officer (ISO) and network administrator to ensure network security, regulatory compliance, and the health of their operations. There should be at least one designated ISO who is responsible for implementing and monitoring the information security program and who reports directly to the board or senior management—not to IT operations management. The significance of segregating the ISO’s duties comes down to oversight: Separating ISO and network administrator tasks helps to create a clear audit trail and ensures risk is being accurately assessed and reported to senior management . It also allows the ISO to provide another “set of eyes” that help to maintain a level of accountability to management, the board, and other stakeholders. The ISO’s independent role primarily serves to ensure the integrity of an institution’s information security program . Financial institutions can also use a virtual ISO to create an additional layer of oversight on top of what they have in place internally. Read more.

Discover these and other key topics about banking compliance, security, and technology on the Safe Systems blog.

Or, subscribe now to be the first to receive the latest updates on banking trends and regulatory guidance directly to your inbox.