Keeping compliance processes and information security up to date is crucial, especially with the ever-increasing risks and regulatory requirements that are facing financial institutions. Our compliance-as-a-service solution, COMPaaS, solves this problem. It offers community banks and credit unions an easy way to customize information technology and compliance services to match their institution’s needs.

What is COMPaaS?

COMPaaS is a collection of connected compliance applications combined with critical monitoring and reporting tools that institutions can customize to address their specific pain points. Regardless of type or size, any financial institution can use COMPaaS to build a unique package of services that are based on their specific compliance resources, expertise, and budget.

The full suite of services meets regulatory requirements in a range of areas from vendor and network management to cloud security, information technology, and business continuity management:

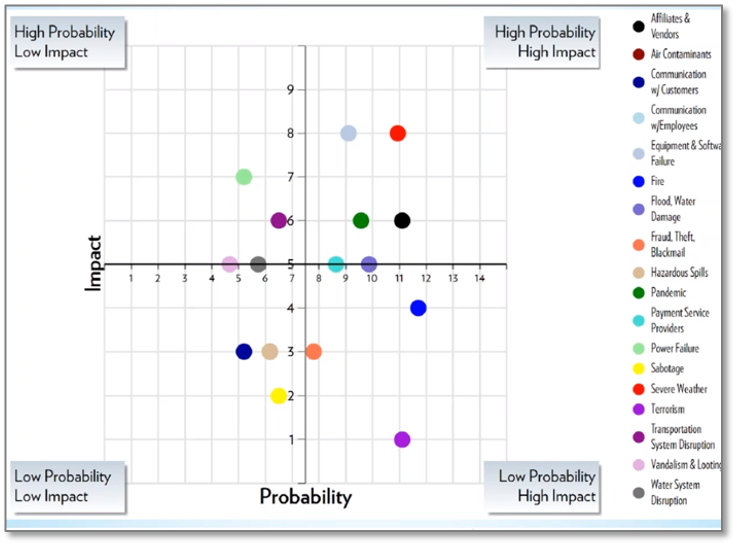

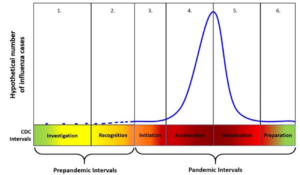

- BCP Blueprint: An application that automates the building and maintenance of a business continuity plan.

- CloudInsight M365 Security Basics: A reporting tool that provides visibility into security settings for Azure Active Directory and M365 tenants.

- Cybersecurity RADAR: A user-friendly application to assess cybersecurity risk and maturity.

- Information Security Program: A proven regulatory framework with applications that allow you to build a customized, interactive, and compliant infosec program.

- Lookout: An event log monitoring solution that efficiently combs through daily logs and sends notifications for activities that need review.

- NetInsight: A reporting tool that runs independently of existing network tools to provide third-party “insight” into IT controls.

- Vendor Management: An application that tracks vendor risks, automates contract renewal reminders, and generates reports.

- V-Scan: A security solution that scans a network, identifies vulnerabilities, and generates a comprehensive report.

How Does It Work?

The COMPaaS applications and services were built with our expert’s core knowledge and industry best practices to help your institution build a strong compliance foundation. Whether you choose one of the automated applications or a service that provides a dedicated compliance resource, COMPaaS can help you better manage your policies and procedures, implement effective controls, and fill in reporting gaps to meet examiner expectations. It is the ideal solution because it lets you select the exact products and services you need now and add more later as your requirements change. For example, if you are a smaller bank, you might begin with a vendor management application and then build from there to cover your cybersecurity risk and information security concerns.

Key Benefits

COMPaaS allows financial institutions to leverage the benefits of automation to streamline time-consuming processes related to regulatory requirements. It converts labor-intensive processes that often exist on paper into apps to create living documents that are more efficient and less likely to become outdated.

COMPaaS also uses technology to enforce verifiable controls and provide consumable reports so that institutions can implement the appropriate actions to maintain information security. This can make it easier to prove to a third party that critical issues are being addressed. In addition, all COMPaaS was designed with the regulatory needs of community banking institutions in mind. For example, the technology and security products cover the standards set by the Federal Financial Institutions Examination Council’s Cybersecurity Assessment Tool (CAT) or the National Credit Union Administration’s Automated Cybersecurity Examination Tool (ACET).

The COMPaaS Advantage

With COMPaaS, institutions have an effective way to target and eliminate their specific compliance and information technology weaknesses. They can save time by automating compliance tasks and save money by selecting only the options where they need help. Institutions also can expand COMPaaS’ services to support internal IT staff who may not be well-versed in a particular area or wearing multiple hats and juggling too many tasks. Or they can use COMPaaS to fill a void when an IT staff member takes a vacation, goes on leave, gets promoted, or retires. Whatever the situation, institutions can maintain continuity by having access to the same tools, reporting features, and experts through COMPaaS. And our solutions will grow with the institution, so it can implement various services at separate times based on its budget and needs.