First Federal Bank ($170, 413,000 in assets) is one of the oldest locally-owned financial institutions in North Carolina, employing a staff of 60 and serving the communities of Angier, NC; Benson, NC; Clayton, NC; Dunn, NC; Erwin NC; and Fuquay-Varina, NC. The bank has a proven history with Safe Systems, originally selecting the company as a vendor partner in 2003 to help it navigate the fast paced change of its business and regulatory environment.

As the industry has continued to evolve and technology has become more advanced, First Federal Bank built on this relationship by adding many of Safe Systems’ solutions and services, including NetComply, Vendor Management, CVault, Safe SysMail, and ultimately, Safe Systems’ disaster recovery (DR) solution, Continuum.

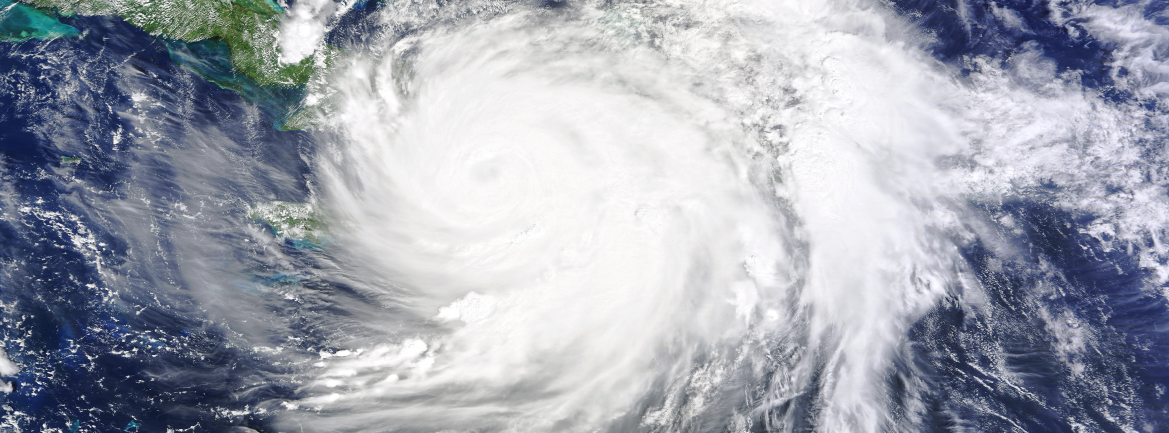

Disaster Strikes the US Eastern Seaboard

In October 2016 Hurricane Matthew wreaked havoc on the Eastern Seaboard of the US, disrupting thousands of businesses and organizations, and impacting millions of people’s lives, including those who worked for First Federal Bank. As the news of the upcoming hurricane became more threatening, the bank and its BCP team began preparing for a possible disaster. While First Federal Bank’s location was forecasted to miss the brunt of the storm, the bank still reviewed its BCP and DR plans and ensured all designated personnel in each branch were fully prepared.

On Wednesday, October 5, Safe Systems was proactive in contacting First Federal Bank to help them manage their BCP process and support the bank’s preparedness for potential disruption. After reviewing all backups to ensure everything was working properly, the bank’s designated strategic advisor at Safe Systems guided bank staff through the entire process, outlining what they needed to do prior to the storm, helped with shutting down servers, ensured the server room was secure, and reinforced the proper communication protocols and contacts were correct and understood.

“Safe Systems served as a true partner for us through the storm and was there to guide us through the entire process, giving peace of mind to all,” said Leigh Barbour, vice president/IT Manager for First Federal Bank.

On Saturday, October 8, the storm hit North Carolina with a lot more force than the forecast predicted, and torrential rain and wind resulted in fallen trees and power lines. While the impact of the storm was more severe than expected, there was no physical damage at any of the bank locations, aside from the fact that the majority of the locations were without power.

On Monday morning, which was a bank holiday, the bank had a conference call with Safe Systems to update them on the situation and discuss the next steps in recovering from the storm. Later that day, the power was restored in most of the bank’s branches except for the Dunn branch and the Corporate Center. The power company said it would be five or seven days before the power would be restored. This news required the disaster recovery team to contact Safe Systems and begin implementing the BCP plan and procedures. Once contacted, the Safe Systems Continuum team worked with the bank to seamlessly switch to the disaster recovery environment. This enabled the bank’s technical environment to be restored remotely, giving them the ability to remotely access its network. Safe Systems colocation then became the actual environment for First Federal Bank, enabling it to securely run all of its solutions from a remote location.

Working together, the disaster recovery teams for First Federal Bank and Safe Systems had the bank ready to operate normally on Tuesday, October 11. Fortunately however, the power was restored Monday evening, so the full Continuum process was not executed.

While the bank and Safe Systems did work hard to ensure the Continuum environment was ready to operate, First Federal Bank reported that the stress of working to recover its network was greatly reduced due to the proactive BCP and DR testing it routinely conducts.

“The last test was completed on August 1, so we felt confident going into the storm that the plan would work and we would be able to resume business as normal in an efficient and timely manner,” said Barbour. “During our test we did cut the connection to our core processor and operated solely from the Continuum environment, which gave us the peace of mind knowing that it was operational and ready to go.”

“Even though we did not execute the full Continuum process, working with Safe Systems through the preparation was very helpful and reassuring,” continued Barbour. “Safe Systems was with us every step of the way to guide us and assure that our systems and processes were working and tested correctly. It is good to know that in the event of a disaster we have a reliable alternative until our environment is restored and a valued partner to support us.”